Bounced Cheques In UAE

Bounced Cheques In The UAE

Bounced cheques are still a very common challenged faced by individuals and companies in the UAE. With electronic transfer payments having been introduced in the country only in recent years, one of the more traditional banking activities still being followed by corporations and individuals in UAE is the practice of issuing cheques. Payments with cheques remain an integral part of the financial system in the country which is why bounced cheques are a common occurrence.

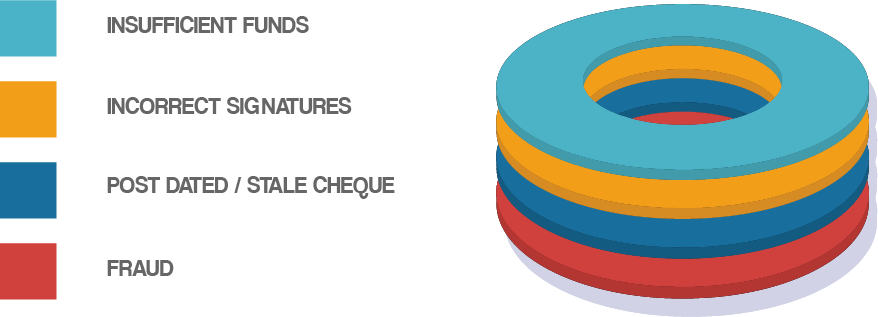

As opposed to other countries, the laws of the United Arab Emirates impose criminal penalties on parties whom issue bounced cheques. An analysis of the reasons of bounced cheques reveal the following:

Both criminal, as well as civil proceedings, can be initiated against the perpetrator. Article 401 of the UAE Federal Penal Code provides that the drawer of bounced cheques should be sentenced to detention (max. 3 years) or fined. Such detention is for a period not less than one month and not more than three years, while the fine is for an amount not less than AED 1,000 and not more than AED 300,000 (fines are payable to the Court Treasury, and not to the beneficiary of the bounced cheque).

Below is a brief description of the points you need to remember if you face either of the unfortunate situations of bounced cheques.

Grace Period of 3 working days to Cheque Issuer

File a police complaint against bounced cheque.

Police will summon the defaulter to settle the amount.

If above fails, Police will transfer the complaint to Public Prosecutor for investigation.

Contact competent Legal Advisor.

Honor the cheque within Grace period of 3 working days.

Settle the matter at Police Station.

Contact competent Legal Advisor.

A fine (penalty) would be charged on cheque defaults below AED 200,000 (USD ~55,000).

Both fine (penalty) and detention for cheque defaults above AED 200,000.